Commercial Block Bank

We are in the market to bring low-cost financial products to the global market. Modernizing the application of international finance across the globe through power of internet via blockchain technology.

We are in the market to bring low-cost financial products to the global market. Modernizing the application of international finance across the globe through power of internet via blockchain technology.

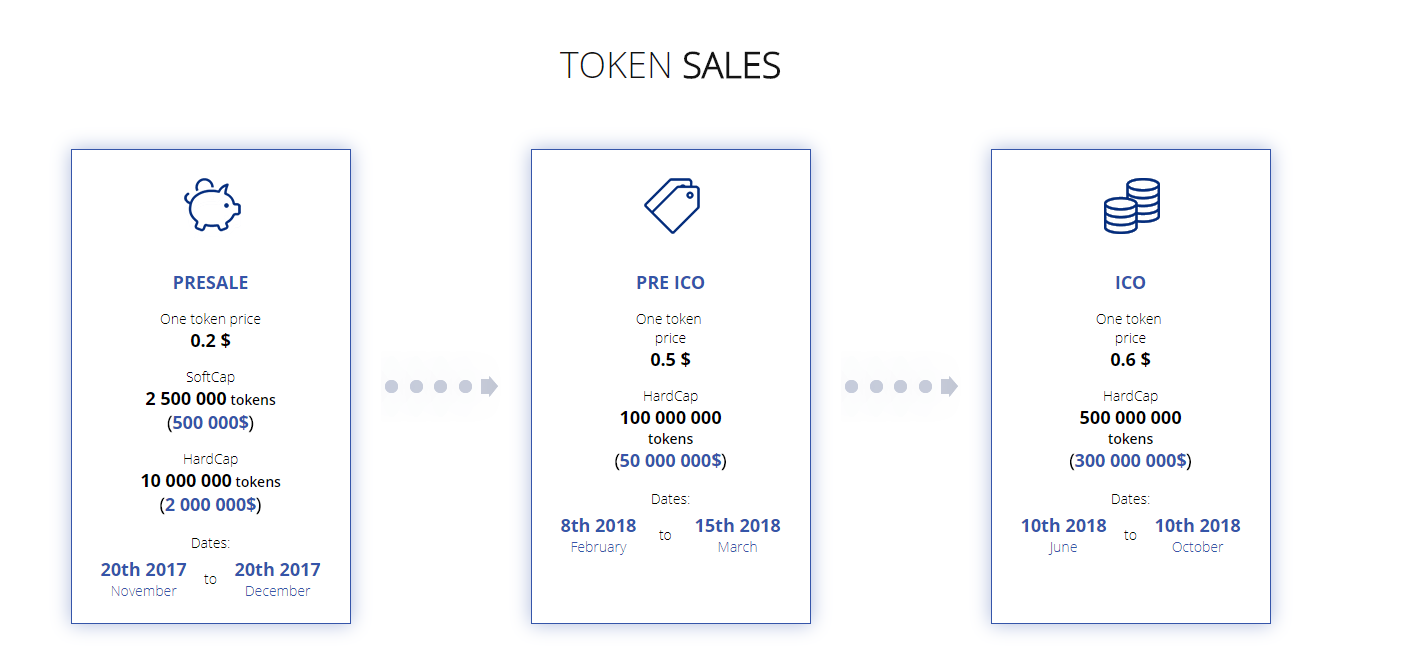

PRE SALE

Symbolic price: $ 0.2

SoftCap: 2,500,000 tokens ($ 500,000)

HardCap: 10 000 000 tokens ($ 2 000 000)

Period: November 20, 2017 through January 20, 2018

Precocious

Symbolic price: $ 0.5

HardCap: 100,000,000 tokens ($ 50,000,000)

Period: February 8, 2018 to March 15, 2018

ICO

Symbolic price: $ 0.6

HardCap: 500,000,000 tokens (300,000,000 $)

Period: June 10, 2018 to October 10, 2018

An opportunity to Join Block Bank!

Block Bank is a decentralized interactive financial platform and is one of the first next-generation banks to use the blockchain to improve the efficiency and security of its financial services. The mission of Block Bank’s mission is to revolutionize the banking industry by offering the most accessible credit to all, including non-bank countries.

The goal of Block BanK is to provide a vertically integrated complete service with blockchain technology that will provide transparency to Block Bank clients and investors. In this way, clients can be assured of the activities of Block Banks and the security of their investees.

Block Bank will also use blockchain technology to streamline business activities and improve efficiency and security.

Symbolic price: $ 0.2

SoftCap: 2,500,000 tokens ($ 500,000)

HardCap: 10 000 000 tokens ($ 2 000 000)

Period: November 20, 2017 through January 20, 2018

Precocious

Symbolic price: $ 0.5

HardCap: 100,000,000 tokens ($ 50,000,000)

Period: February 8, 2018 to March 15, 2018

ICO

Symbolic price: $ 0.6

HardCap: 500,000,000 tokens (300,000,000 $)

Period: June 10, 2018 to October 10, 2018

An opportunity to Join Block Bank!

Block Bank is a decentralized interactive financial platform and is one of the first next-generation banks to use the blockchain to improve the efficiency and security of its financial services. The mission of Block Bank’s mission is to revolutionize the banking industry by offering the most accessible credit to all, including non-bank countries.

The goal of Block BanK is to provide a vertically integrated complete service with blockchain technology that will provide transparency to Block Bank clients and investors. In this way, clients can be assured of the activities of Block Banks and the security of their investees.

Block Bank will also use blockchain technology to streamline business activities and improve efficiency and security.

Milestone we needed to achieve after the ICO will be to:

Development of decentralized Block Bank financial platform with an investor partnership that believes in the profitability of this business. Such powerful tools will be created through traditional online banking services.

The main advantage of Block Bank is the technology blockchain that customers may have total visibility on the investments or loans they will refer to, because the block chain can be used to monitor your transactions. Building this technology will be a top priority and should capture enthusiasts from around the world to maximize the development of this platform, increasing the demand and supply of the Block Bank network. This platform can be expanded to monitor banking services, bonuses, deposits and other financial data. Customers will be able to manage their own businesses without third-party intermediation. The project is strongly supported by the crypto world enthusiast community. And the BlocK Bank team hopes to achieve the costs necessary for the project to progress.

Development of decentralized Block Bank financial platform with an investor partnership that believes in the profitability of this business. Such powerful tools will be created through traditional online banking services.

The main advantage of Block Bank is the technology blockchain that customers may have total visibility on the investments or loans they will refer to, because the block chain can be used to monitor your transactions. Building this technology will be a top priority and should capture enthusiasts from around the world to maximize the development of this platform, increasing the demand and supply of the Block Bank network. This platform can be expanded to monitor banking services, bonuses, deposits and other financial data. Customers will be able to manage their own businesses without third-party intermediation. The project is strongly supported by the crypto world enthusiast community. And the BlocK Bank team hopes to achieve the costs necessary for the project to progress.

ICO Block Bank — http://theblock-bank.com/

Block Bank is the first platform for digital financing that is not only aimed at achieving profit, but at satisfying people’s needs as well. The platform will automatically work in online mode, promoting inexpensive commercial products to previously unattainable markets.

Block Bank is one of the first world cryptocurrency banks that will provide services to meet global need in decentralized commercial financing.

Block Bank will provide budgetary financing for commercial organizations all over the world, which will reduce the gap in access for low-cost financing products. The Block Bank will aim at revolutionizing the banking industry, as well as making loans more affordable even for non-banking countries. Block Bank will be used as a decentralized financing platform financed by a cryptosystem. There is the intention to use the bank as a source of financing, oriented to meet people’s needs.

We use all the benefits the technology of the XXI century provides us. Global financial markets currently provide low-percentage loans exclusively to financial institutions, while the environment, infrastructure, social and medical institutions are in a great need of financing as well. Crypto Banks will become the foundation of a new decentralized economy due to the expansion of payment options, minimum taxes, increased speed and security. The company believes that tomorrow banks will look completely different, and the Block Bank is exactly the bank that leads to these changes.

WHAT IS TOKEN?

A token is a representation of value, a sort of digital asset (dasset). The Ethereum developers decided to standardize this process, and so the ERC20 ‘Token Standard’ was created. This templated-contract standardization contains a series of functions that enables the issuance, distribution and control of the assets in a formalized, standardized manner.

A token standard allows for the ease of interoperability between DApps (decentralized applications built on the Ethereum public chain) and the tokens built by the programmers.

Globally, 48 trillion Reward Points from Brands that are worth close to $360 billion go unredeemed each year. When users sign up for memberships with different Brands, they collect these points for every action taken, be it signing up, or making a purchase among others. But, they usually end up in a situation where the points can neither be consolidated nor redeemed against a preferred reward (the reward they want) due to restrictions. These restrictions include limited avenues, limited products inside a catalogue etc. In short, users are left with limited choice and a cumbersome reward programme that they often end up discarding.

A token is a representation of value, a sort of digital asset (dasset). The Ethereum developers decided to standardize this process, and so the ERC20 ‘Token Standard’ was created. This templated-contract standardization contains a series of functions that enables the issuance, distribution and control of the assets in a formalized, standardized manner.

A token standard allows for the ease of interoperability between DApps (decentralized applications built on the Ethereum public chain) and the tokens built by the programmers.

Globally, 48 trillion Reward Points from Brands that are worth close to $360 billion go unredeemed each year. When users sign up for memberships with different Brands, they collect these points for every action taken, be it signing up, or making a purchase among others. But, they usually end up in a situation where the points can neither be consolidated nor redeemed against a preferred reward (the reward they want) due to restrictions. These restrictions include limited avenues, limited products inside a catalogue etc. In short, users are left with limited choice and a cumbersome reward programme that they often end up discarding.

A decentralized source of funding will provide financial services to commercial organizations in a digital and physical way in accordance with International Law. Customers will benefit from customized financing products and low-cost financing options, as well as for international banking and financial services. Customers will be able to lend acceptable assets, as well as cryptocurrency. Fiat money is a currency without intrinsic value, established as a payment mean by government regulation or by law, for example, USD, EUR, GBP. The bank will be able to provide money to business.

Block Bank will use blockchain technology to deliver products to customers through smart contracts. This means that the main banking system will perform most of its tasks automatically. Smart contracts will ensure transparency of external parties and communities. Smart contracts will also provide Bank Bank customers with additional security and reliable transactions. The blockchain technology completely solves the problem of cross-border participation in the banking system. This allows uniting users from all over the world, minimizing transaction costs, maximizing the efficiency of capital flows around the world. The ability to obtain loans with minimal fees and taxes, regardless of a user’s location, can be made possible through innovative blockchain technology.

Block Bank allows consolidating key performance indicators, as well as keeping records in real time, regardless of the location or size of a business. It does not matter if you want high-level personnel to view accounts in several geographic regions or to create accounting books within few seconds, the Block Block real-time cloud environment eliminates manual, error-prone and costly efforts typical for many obsolete systems.

MORE INFROMATIONS

Website : http://theblock-bank.com/

Whitepaper : http://theblock-bank.com/pdf/blockbank_whitepaper.pdf

Telegram : https://t.me/BlockBank_cash

Twitter : https://twitter.com/block_bank

Website : http://theblock-bank.com/

Whitepaper : http://theblock-bank.com/pdf/blockbank_whitepaper.pdf

Telegram : https://t.me/BlockBank_cash

Twitter : https://twitter.com/block_bank

cryptobits3

0xb101dC14C6012D4faC2025a8f1Cdd4Daf1D9F154